Wednesday, May 10, 2023

The US Bureau of Labor Statistics measures 80,000 prices every single month from thousands of retail shops & they include housing & rent prices to create the consumer price index number.

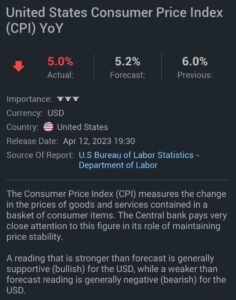

The consumer price index measures the change in prices of goods and services contained in a basket of consumer items. The central bank pays very close attention to this figure in its role, maintaining price stability.

So of course, if inflation starts to pick up again, there will be speculation that the Federal Reserve will need to hike interest rates even further to contain inflation.

Why does hiking interest rates contain inflation?

It takes money out of the pocket of consumers and companies, businesses, because they spend more on their interest payments,

whether that be companies borrowing for machines or households borrowing on their credit cards or a mortgage, the cost of loans goes up, which means we’ve all got less money in our pocket.

So it’s a drain on the economy. It removes upward pressure on inflation because there’s less demand for goods and services.

Now, whilst that could lead to recession, because spending goes down, perversely stock markets, will see it as a great thing if the inflation starts to slow, if the economy starts to slow, it will mean the Federal Reserve will not put interest rates up further.

The interest rate cut cycle will begin sooner rather than later, so financial markets will take that as encouraging.

Stock markets, will probably go up a little bit if inflation is lower than the forecast of 5.2%.

If the forecast is higher than expected, let’s say it jumps to 5.4%, then that would increase speculation that the Federal Reserve have not finished raising interest rates. That would be negative for the stock market.

It would be bullish, probably for the US dollar, because higher interest rates attract speculators into the dollar because they want to get a good return on their money.

If the C P I number is higher than expected, it could also be quite negative for gold, because gold does not produce a yield.

There is no return on gold. You just hold it in the hope that price goes up in the future.

If inflation creeps up and interest rates could be seen as rising again, then the investors would rather have their money in bonds, savings accounts to take advantage of the interest rate.

Also out this week is the United States Producer Price Index.

Very similar to the consumer price index, but it measures a change in the input of prices of raw, semi-finished or finished goods and services.

Manufacturers and producers may try to absorb some of the cost. If prices increase, they may not want to pass all of that cost onto consumers because they may want to retain market share.

But if the producer price index rises, it could feed through eventually to the consumer price index.

So it is certainly a very important number and therefore, if the PPI number comes in above the forecast, it would have the same sort of effect as the CPI number.

We’ve also got the UPS import price index and export price index.

The import price index obviously measures the price of imported goods and services. The export Price index measures the price of exported goods and services.

Import price index is probably more important because if the price of imported goods is going up, that would lead to a higher P P I and eventually a higher C P I.

If the dollar sinks, then immediately the cost of imported goods and services goes up, so that would be more inflationary. If the value of the dollar goes up, it means that the cost of buying goods abroad is cheaper, so that can have a deflationary effect.

US Michigan consumer sentiment is a survey of consumers.

The reading is compiled from a survey of around 500 consumers that take a cross section of society and they ask them how they feel about the economy.

Is the economy gonna do better? How confident do you feel about the future of the economy? That kind of thing. And it just gives us an idea of how the consumer feels.

If the consumer feels confident, the markets will feel that they could spend more, so it could be slightly inflationary.

If consumers are nervous, it means they might save more, spend less, which would be a negative for the economy, but it also might be slightly deflationary, which would be a good thing.

On Thursday, the Bank of England will decide the level of interest rates.

Currently at 4.25%, Bank of England is expected to leave interest rates unchanged.

If the Bank of England was to unexpectedly raise interest rates that would have quite a significant effect, probably hit the stock market, the FTSE at least,

and it would probably lead to a significant increase in the pound against other currencies because it would’ve been unexpected and it would attract investors looking to get a better return on their investments.

One thing that could affect the Bank of England decision on interest rates, maybe not as soon as Thursday, but going forward, would be the UK Gross Domestic product number.

So this is a measure of productivity in the economy. It gauges the inflation adjusted value of all goods and services produced within the economy.

It’s the most comprehensive measure of economic activity and an important indicator of economic health.

Currently this number is positive so the UK economy is still growing. The forecast is for the economy to grow by 0.4%. The actual number last month was 0.6%.

So despite the interest rate rises and worries about inflation, the UK economy remains in a growth phase.

Obviously, if the economy keeps growing, it may put upward pressure on inflation because consumers will be doing well. They’ll be getting the jobs they want.

They may even be getting pay rises, which of course puts more money in their pocket and it may lead to further inflation. So it is a very important number.