Wednesday, August 25, 2021

When the Delta variant became the dominant strain of Covid-19 in India and the U.K. earlier this year, Americans had little idea what future impacts would be to the continental U.S. in the coming months.

According to John Hopkins University, since Jan 1 of 2021, there have been 16,578,509 cases of Covid-19 in the U.S. The latest seven-day moving average of new daily cases rose to 130,710 on Monday (Aug 16), the highest level since February and up from 13,118 at the end of June. That's a 10-fold increase in just a month and a half! Hospitals in many states, including FL and TX, are overwhelmed with coronavirus patients and repurposing hospital wings for overflow if they are able. Often alternate facilities are overcapacity, and there is no place to transfer patients putting their lives in peril.

To combat the newest wave of infections, mask mandates and vaccination passports are becoming the standard in workplaces, business services, recreational facilities, and restaurants. Last week NYC enforced vaccine passports and mask mandates for restaurants, gyms, and other recreational facilities. Federal Government workers must wear masks and be fully vaccinated. Many private sector companies have returned to mask mandates and now require complete vaccination as a condition of employment. According to Indeed, a leading job posting website, more job postings now require vaccinations, and large corporations like McDonald's and United Airlines are leading the charge. Several companies are delaying re-openings until next year, and many employees are hesitant to return to the office for fear of contracting the virus.

Delta Variant in the Data

In the past several weeks, we see a slowdown in the economic recovery in the economic data. Economic growth for 2021 most likely peaked in the 2nd quarter when GDP came in at an impressive 6.5% and consumer spending was up a whopping 11.8%! Traveling had come back with a vengeance in the spring as vaccinations increased and people were desperate to go anywhere. Fast forward to July, the pace of airline reservations dropped from those spring highs, and fares are lower with the newest spike of Delta variant infections. Hotels and cruise lines followed suit reflecting weaker overall demand.

Consumer confidence is a harbinger of spending activity going forward. The University of Michigan Sentiment index fell sharply to 70.2 in the first half of August, down from 81.2 in July as respondents expressed concerns about the Delta variant. That's a drastic decline in confidence from groups of all ages, incomes, education, and regions. When consumer confidence wanes, so does consumer spending.

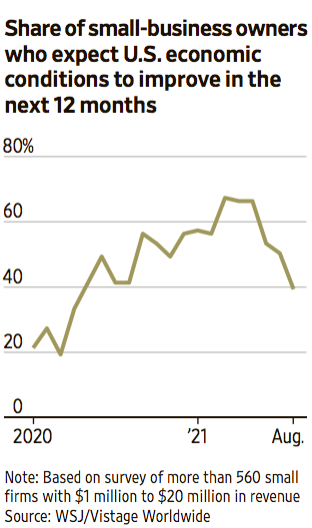

Small business confidence fell to its lowest level in August since early spring as rising Delta variant cases changed business owners' expectations. According to a WSJ/Vistage Worldwide survey, only thirty-nine percent of small business owners expect economic conditions to improve over the next year, down from 50% in July and 67% in March (see graph below.)

Retail sales fell 1.1% in July compared to June. Ex-autos, one of the most volatile sectors, sales were down 0.4%. Retail Sales data reflects sales for 13 major types of retailers and is a good measure of inflationary pressures in the economy.

After the July Federal Reserve meeting, Fed Chair Powell publicly expressed concern about the impact of the Delta variant on the economic recovery. The Fed's primary tasks are controlling inflation (the pace is gradually easing) and promoting a stable labor market through monetary policy. Despite the high rate of Delta variant infections, weekly jobless claims fell to a new pandemic low for the week ending August 13th, declining four weeks in a row, and are down more than 50% since January. However, let us not forget there are still 10.2 million unfilled jobs in the U.S. The Fed has signaled over the last few months that they are likely to begin tapering securities purchases (monetary stimulus) by the end of this year. Will the Delta variant continue to spread at a level that will derail those plans?

As a trader for many years, I was trained to see the downside of things. However, there is a new upside in the Delta variant picture. All Covid-19 vaccinations have been available through Federal emergency status; the vaccines were not FDA approved. Today the Pfizer vaccine received full FDA approval. Moderna and J & J will follow suit within a short period. Employers who have been hesitant to require vaccines may now feel that they are on higher moral ground and mandate vaccinations for their employees. Hopefully, individuals waiting for official FDA approval to get vaccinated will take the plunge and get the shot. Not everyone will get vaccinated, but let's hope this approval and the ones to follow raises the number of new vaccinations significantly enough to get the virus under control.

KPI's of Interest

United States ISM Purchasing Managers Index (PMI)

https://tradingeconomics.com/united-states/business-confidence

United States Consumer Price Index (CPI)

https://tradingeconomics.com/united-states/consumer-spending

Sources: Wall Street Journal, U.S. Bureau of Labor Statistics, CNBC, Fox Business News, MarketWatch, Econbrowser.com, New.metal.com, CNN.com, John Hopkins University, Tradingeconomics.com, cmegroup.com

Deborah Brown – C.E.O. DDB Advisory Services

Impact on Supply Chains

The United States and other advanced economies have been vigilant in getting 50% and 40%, respectively, of their populations vaccinated. This vaccination diligence has paid off in the form of robust economic recovery. The recovery was also made possible through gradually improving supply chains worldwide. Recent research is validating my observations with my clients. Across several industrial sectors, I am hearing that the rate of price increases is declining, material availability has improved, fewer employees are leaving, and they can fill more vacant positions.

The concern is that most of our supply chains are reliant on emerging market economies. These economies lag behind the US and other advanced economies in vaccination penetration, with an average of 20% of their populations vaccinated. Because of the low vaccination rates, the COVID-19 Delta variant is wreaking economic havoc, requiring more lockdowns and social distancing. These measures have a direct effect by closing factories, logistic networks, and ports. Our supply chains will likely suffer if emerging economies are unable to reverse their vaccination deficiencies.

I'm not suggesting we will fall off a cliff. However, recovery to supply chains will be three steps forward, with one or two steps backward for the next fifteen to eighteen months.

Art Koch – AKMC, LLC

If you have any questions or concerns about your operations and supply chain business strategy, please contact me by e-mail or at +1 (336) 260-9441.

Follow me | LinkedIn | FaceBook | Twitter | YouTube | Global Business Advisors Forums | Global Manufacturing and Supply Chain Think Tank and SIG | The Idiots Guide to Supply Chain Management | Instagram

Art Koch's Profit Chain®

Dramatic improvements to inventory velocity, increased customer service, and corporate profits.

Entropy Busters®

Stop letting the process manage you! Become the champion of your game plan and achieve sustainable profits.

The Inventory Doctor®

Assessing the health of enterprise inventory and procurement practices.

Inventory Is Evil!™

Inventory delays problem resolution. Delays cost money.

Art Koch's Profit Chain®, The Inventory Doctor®, and Entropy Busters® are the registered trademarks of Arthur Koch Management Consulting, LLC.

Turning Operational Problems into ProfitsSM is a pending trademark of Arthur Koch Management Consulting, LLC.

© 2021 Arthur Koch Management Consulting, LLC, all rights reserved.