Tuesday, January 29, 2019

HomeWork Solutions' co-founder Kathy Webb recently participated in a nanny educational program focused around legal nanny payroll. In the course of discussions, attendees were anxious for some concrete examples on how the negotiation of pre-tax benefits for health insurance reimbursement and professional development could be cost neutral to a family and a big win for the nanny.

HomeWork Solutions' co-founder Kathy Webb recently participated in a nanny educational program focused around legal nanny payroll. In the course of discussions, attendees were anxious for some concrete examples on how the negotiation of pre-tax benefits for health insurance reimbursement and professional development could be cost neutral to a family and a big win for the nanny.

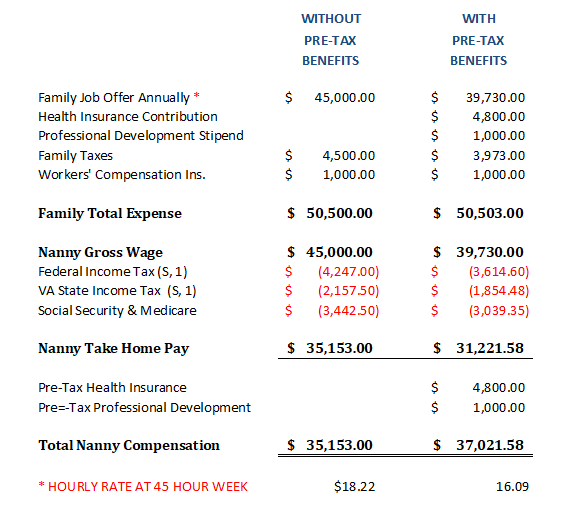

The example below demonstrates how a family who was prepared to offer the nanny annual compensation of $45,000 for a 45 hour work week could "sweeten the pot" to a candidate who valued paying for health insurance tax free and attendance at an annual professional development event such as the International Nanny Association's annual conference or NannyPalooza.

The calculations above illustrate how a nanny can receive $5,800 a year in non-taxable benefits, and still clear almost $2000 a year more in total compensation all while keeping the family's budget neutral.

WIN - WIN