Tuesday, August 7, 2018

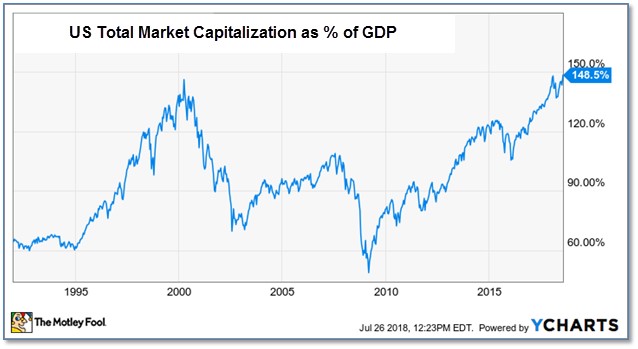

Legendary investor Warren Buffett's favorite metric of stock valuations is currently suggesting that a stock market setback could be coming. While anything from Buffett brings up memories of the television commercials from the 1970's that with the tag line "When E.F. Hutton talks, people listen", Buffett's favorite indicator is both historically effective and remarkably simple to calculate. The indicator is simply the ratio of the total market capitalization of all U.S. stocks divided by the latest Gross Domestic Product (GDP) reading. Of concern is that the current value of this ratio has never been higher.

While no indicator is correct 100% of the time, the Buffett indicator is remarkably accurate. As a general rule, if the indicator falls below 80-90%, it has historically signaled that stocks are cheap. Likewise, levels significantly higher than 100% can indicate stocks are too expensive. For example, the Buffett indicator peaked at 145% right before the dot.com bubble burst, and reached 110% before the financial crisis. Where does it stand now? 149%. (Chart from motleyfool.com)